Funding sources to boost your business

What are the funding sources?

All businesses need funding to operate and develop their projects. But, how many types of funding exist and how can we get them?

Any company, idea, or business requires financial support to reach its goals. Some help –additional to internal resources– coming from a number of the available funding sources will make the way to success easier. This post will deal with all kinds of available funding. But before that, what are the funding sources?

If funding is the process of raising these funds, the funding sources are the agents from where this funds are coming. That is, those actors such as banks, or public/private entities you can address to raise these funds.

Funding needs will be there in all periods of business activity in different forms and always focused torwards an objective. We may need funding to buy premises, machinery, invest in R&D, develop a new web, open an e-commerce line, or going international.

The different funding sources we may have access to will provide economic help for our objectives. Nevertheless, and in the case of public funding, the destination of the funds must be focused to the aim for which the funding was offered.

Funding typology and diversification

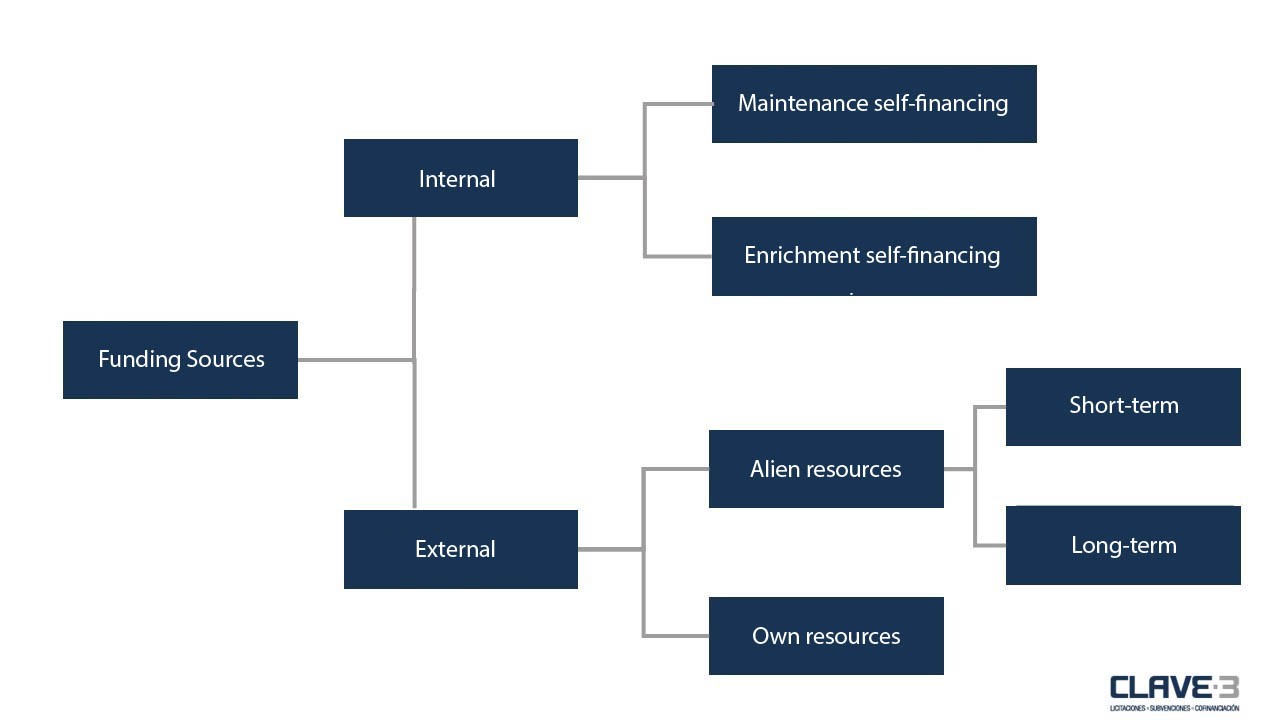

Funding sources may be divided into two typologies:

- Internal, which are those belonging to the company or are generated from its profit.

- Externas, que son aquellas que suponen una financiación adicional que procede de fuera de la empresa. External, which imply funding coming from outside the company’s perimeter.

In either case, it is essential stating how much funding is required in order to define the most suitable typology. It is also important to keep in mind the funding concepts described in the following tree:

Internal funding is also known as self-financing as it refers to those resources generated by the company’s activity. As we see in this image, there are two types:

- Maintenance self-financing. The business profit is kept to maintain its production capacity. This is equivalent to “provisions” and “amortisations” in bookkeeping.

- Enrichment self-financing. Profit is used in this case in investments oriented to the business growth.

External funding, on the other hand, is that financing source which is alien to the company’s economic activity. Two groups:

- Those financial resources coming to the company from outside its perimeter. For instance, listing in stock exchange, new shareholders, etc.

- Those funding resources coming from outside the company. There are two kinds of them: short-term funding (such as leasing, commercial discounts,…) and long-term funding (mortgage, personal loan,…). Time is the key factor that determines a category or the other according to the refunding deadline: short-term if in less than a year, or long-term if longer.

This variety of the funding possibilities is an advantage. Any business can diversify its funding sources both internally and externally, or either increasing the number of banks with which it works or applying for the many public aids that exist at present.

External funding

Subisidies

Can I really apply for a subisidy? My business is located in a small town, can I have access to a public incentive? Are subsidies only for big companies? We would like to answer these and many other questions. We will try to explain all you need to know about public incentives and aids so that your business does not miss an opportunity.

All public authorities, never mind their scope of action (let it be European, national, regional, or local) provide companies with economic aids in accordance to their policy.

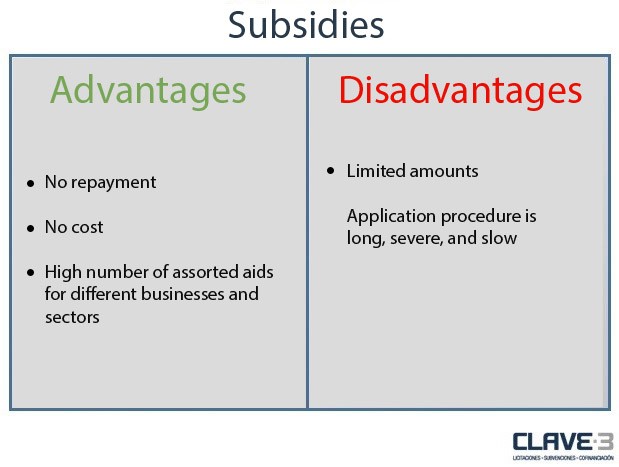

Public authorities subsidies are a financial support that require no refunding (unlike bank loans) and which are changing constantly. Deadlines, amount, and requirements vary according to the date and the authority accountable for a particular subsidy. This –plus the excessive bureaucracy– makes quite complex and tedious the procedure. It is strongly advised engaging experts in .

Despite there is a number of subsidies which vary according to the business and the economic sector, the amount is not quite high. It is also a slow process and no business should rely on them on the short term. Nevertheless, they still are one of the main and most usefull funding sources. In fact, they are a funding means which is suitable for any business. For further detailed information on subsidies, please read this post.

Bank sector

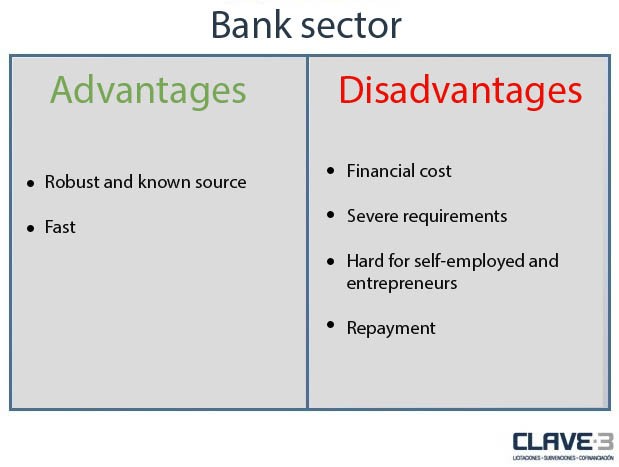

Who is unaware of the funding opportunities offered by banks? Banks are, no doubt, the most used funding resource by businesses. Main reason is that it is also the most widely known and offers a great number of custom products: personal loans, mortgages, credit, discount lines, etc. On top of that, sometimes the bank may inquire information regarding the destination of the loan, but that does not mean you must necessarily use it in buying machinery, raw material acquisition, or the development of a website, as it happens to public funding.

However, it must be kept in mind it generates a financial cost that should be taken into account in the business prospects. This is why this type of funding is the quickest, most accesible, and simple for longstandign businesses. These companies typically have the guarantees that enable the loan granting. On the other hand, it is harder for self-employed persons and entrepreneurs.

The following table summarizes graphically the main advantages and disadvantages of a bank loan for a business:

Venture capital

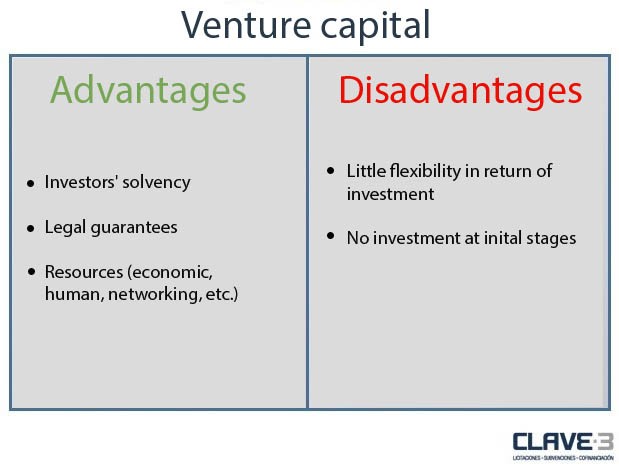

Venture capital is possibly one of the least known funding sources. But it is very interesting as regards entrepreneurs. It provides funds to those business from which a fast and successful projection is expected in case the get the necessary funds for their inital stages. They are usually startup companies with new business or tech models. Headhunters consider them a real business opportunity and also a chance to multiply their investment with the business profit. The compensation for this investment is a share in the company capital plus a managing position. Main advantage, on top of the level of resources they provide, is a legal support and third parties’ creditworthiness.

In case the company is in a very initial stage, they do not usually bet for it since the projecto is not seen clearly yet. This funding goes mainly to projects already on progress but which need a push to reach real success.

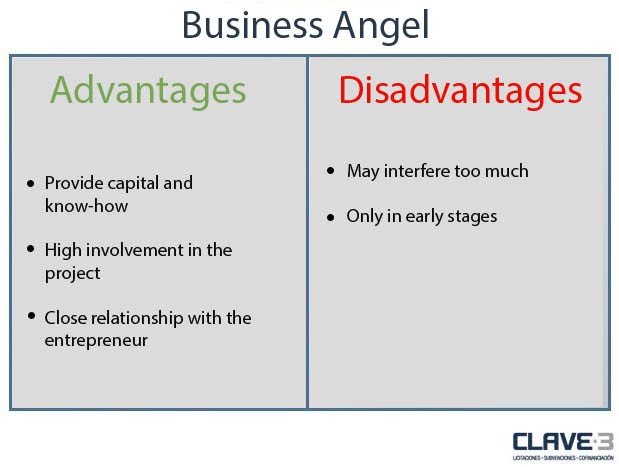

Business Angels

This kind of external funding is a very particular one. The Business Angel character was born in the USA with those businessmen who supported –in the 20th century– Broadway stage productions. Transferred to the business field, a Business Angel is a person who sponsors a project because he likes it or believes in it; let that be for its innovation, impact on society or for simple personal reasons. This “angel” provides his own money (a venture capital invests money from third persons), experience, know-how, and network. That is, he involves rather more than a venture capital providing resources beyond economic funding.

Though this funding source is to be found mainly in the USA –Amazon, Skype, and Google had it in their early days–, it is also present in Spain. It is, no doubt, a useful financing source that will also accompany you (perhaps, sometimes too much) whith his know-how through the business creation process. Tech start-ups and the like are usually the kind of companies these investors are most interested in.

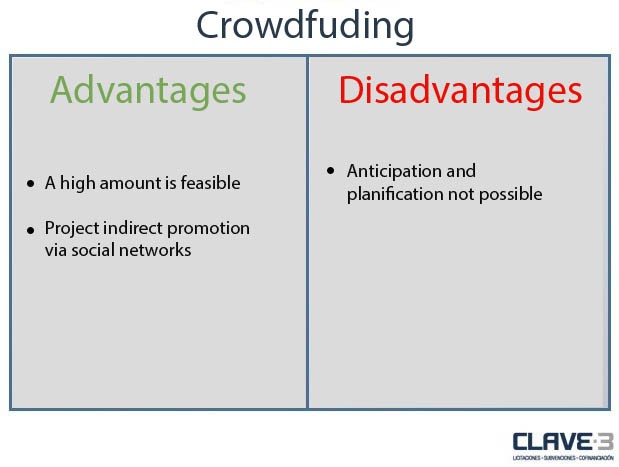

Crowdfounding

Internet is a “before and after” for business. It cleared the way for new sales and commercialization models, as well as for new funding models.

This technology has not only allowed new means for product promotion for the entrepreneur, bus also a new source of opportunities for a project with new forms to boost it.

New forms of economic support for businesses and entrepreneurs have appeared, such as crowdunding or micropatronage. This is a collective funding means (mainly online) executed by individual persons in compensation to rewards (products, discount, acknowledgement,…) or even for simple altruism. This is one of the most popular funding source for artistic projects and is also much used as support to political campaigns by recent creation parties.

But, how does crowdfunding campaigns work? It is quite simple. The entrepreneur sends his business idea to a platform and just wait for contributions from the audience. In order to obtain a higher number of contributions it will be essential that the project be written attractively and proves its viability or support to a concrete cause.

The proposal will be accesible for a particular time, hence the importance it captures the attention of the potential contribuitors as soon as possible. Crowdfunding is an ideal financing source for those innovative projects with a high social concern so that people may feel engaged enough as to contribuite.

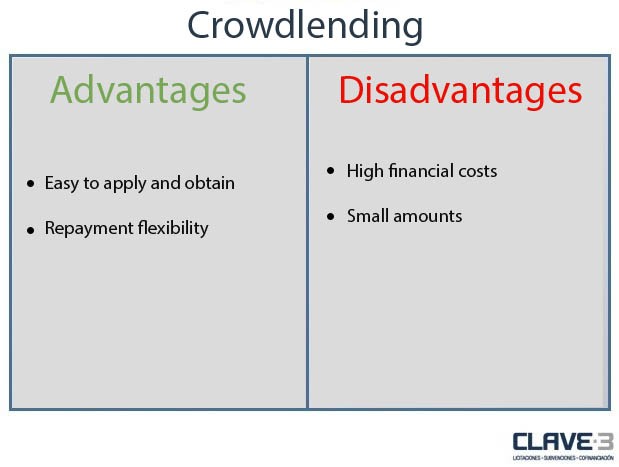

Crowdlending

Crowdlending is also a collective funding means. It relies on the principles of crowdfunding, however funding does not come from donations, but from loans from particular persons. This allows a direct funding means from a big and diverse group of persons for all kind of businesses and without requesting a loan from a bank. People lends small amounts of money for a stipulated financial return in a loan contract.

It is fast and easy to apply, unlike a bank loan, and offers flexibilities for repayment. Nevertheless, there is a high financial cost due to its high risk. Crowdlending has become an alternative funding source when no other sources are available, especially for self-employed persons and entrepreneurs.

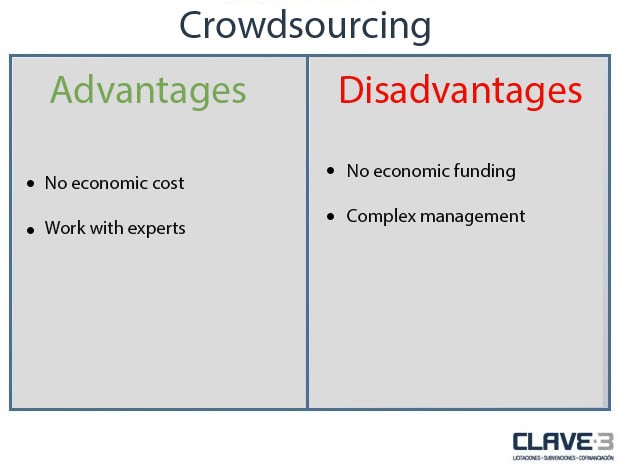

Crowdsourcing

Crows sourcing is not a funding source as such. Its purpose is obtaining either financial or human resources for the development of a business idea. It allows task externalization which are covered collaboratively with the objective of minimizing the company’s workload. This removes a number of financing barriers.

This is a good option since it does not require economic costs and, in case the project is interesting, may lead to work with first level experts.

Entrepreneurs and start-ups usually turn to this alternative funding. It does not only enriches the project economically, but it also benefits from others’ know-how, experience and other added value aspects.

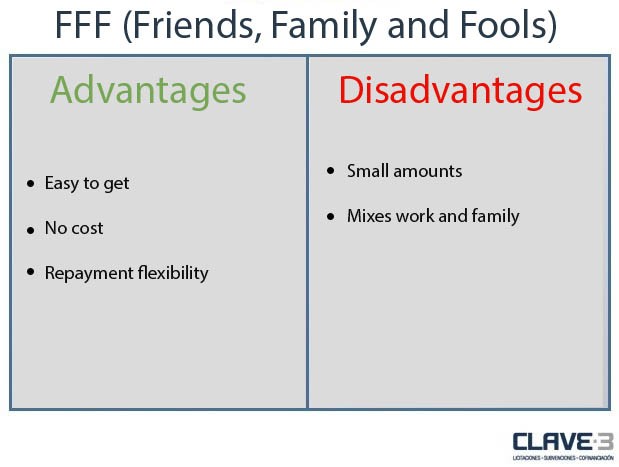

FFF

FFF stands for “Friends, Family and Fools”. These are the first three sources to which any entrepreneur appeals due to their proximity.

It may seem hardly serious, but most companies started and do start working with the resources they have available in their immediate context. It is an economic help that fits any business at an initial stage.

Internal fundig

External funding shows a huge variety of resources in a continuous reinvention process. Internal funding, on the contrary, is much more conservative and limited. However self-financing is quite important as it means financial independence leaving aside any external funding sources.

A business which works with its own resources conveys external confidence and boosts the approach of others for collaboration.

Internal funding comprises four main resources:

- Shareholders capitalization: These are the economic contributions from shareholders or owners. In the case of limited partnership businesses –the most usual SMEs legal status–, partners must invest, at the very least, 3,000 euros of share capital and may make further contributions afterwards. The same applies for a self-employed person who gives money to his own business.

- Capitalization reserves: Business organizations must have a legal capitalization reserve (which does not mean excluding a voluntary additional one) comprised of a profit percentage not distributed among shareholders. This capital works as a “piggy bank” for those circumstances in which the company may need additional funding. There are three kind of capitalization reserves:

- Reserves coming from not shared profit.

- Reserves coming from balance sheet.

- Reserves coming from shareholders contributions.

- Income statement. This is the most obvious source for internal funding, the profit and loss account. The possibility of financing the business and generating capitalization reserves will depend on the benefits obtained on the year.

- Amortization: Any asset –either material or inmaterial– suffers a value depreciation as a consequence of the economic activity. These losses are indicated in the bookkeeping and fiscally (amortizations); hence they reduce the taxable base of the corporate tax, which means a remarkable fiscal saving.

What is the best funding source for your company?

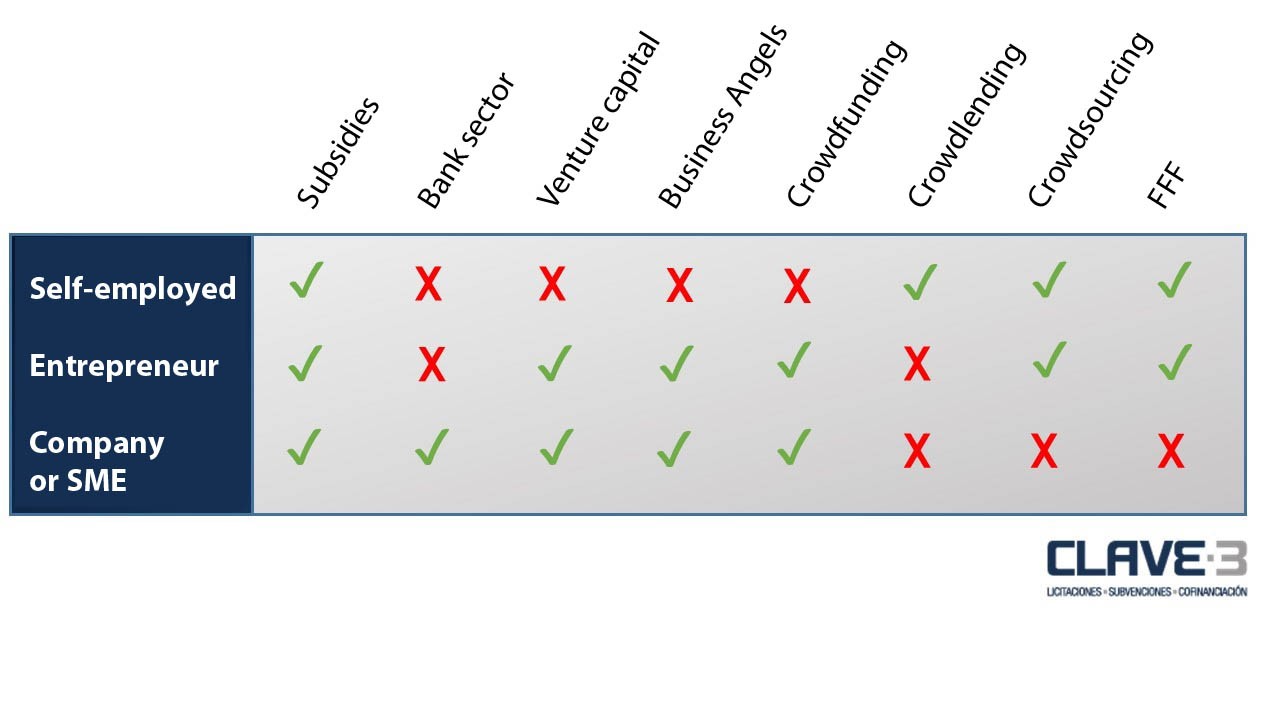

Once described the main funding sources, this is a summary* table to check the most suitable financing source for you business.

*This table shows only external funding since internal –in a way or another– are inherent to any business. The table is based on the characteristics of each funding source and its sinergy (either positive or negative) with the indicated kind of business.